06 Jun The Cost of Doing Nothing

A SIMPLE SOLUTION TO A COMPLEX QUESTION

While our government currently reports an annual inflation rate of 5% for 2023, price increases feel closer to 15% or more. Almost everything I touch in my day-to-day life has more than a 5% price increase. No one can predict the future, but we could see an extended period of higher-than-normal inflation rates.

The question for investors today and for the next several years is how to combat and thrive in an inflationary period. While I still believe that cash “can be” king, my position has evolved. Cash and hard assets that produce cash flow/dividends and appreciation can make a kingdom. Today, there is no way I would sit in a large cash position for the next 4-7 years, waiting for inflation to reach the 2% level the government has stated as its goal.

BUILD YOUR KINGDOM – STAY IN FRONT OF INFLATION

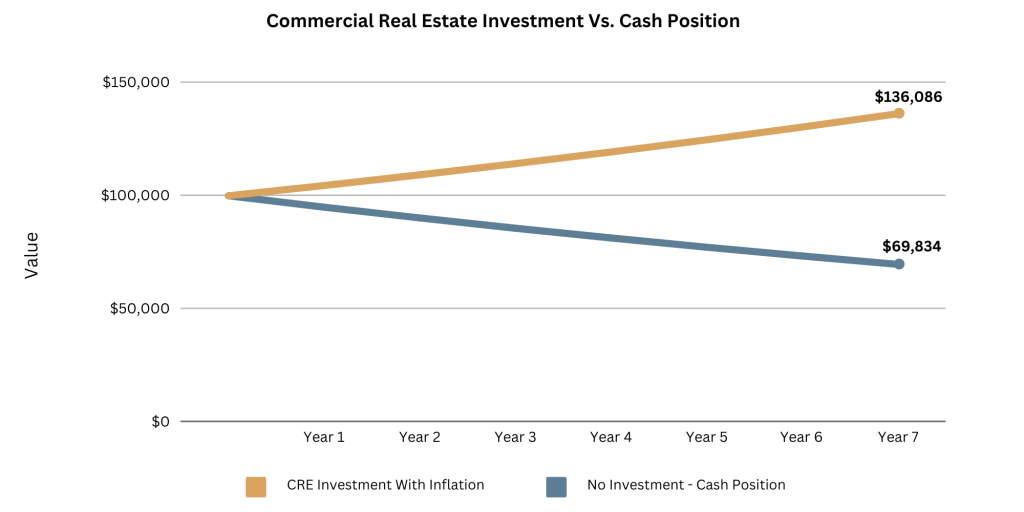

Below is an example and a comparison of what could happen to your $100,000 sitting in your bank account while inflation eats away at your cash like a ghost tax. What if that $100,000 is invested in Commercial Real Estate? Could it help you stay in front of inflation for the next decade? The answer is Yes.

This example is a generalization. In reality, investment returns could be higher or lower; the same can be said for inflation. The main point is to compare an investment at a 10% annualized rate of return factoring in a 5% inflation rate versus holding cash with no investment accepting a recognized 5% annualized loss on your money.

OFFSET INFLATION WITH CRE INVESTMENTS

Unfortunately, we know inflation has your buying power in the crosshairs. Those that take a proactive stance to secure investments that could offset inflation will be in a far better position over the next decade.

Take the next step and invest in CRE to hedge against inflation. Click Here for details on our current offering or email info@PresarioVentures.com.

To learn more about Presario Ventures, sign up for our newsletter or schedule a meeting with our team.

Follow us on LinkedIn, Facebook, Twitter, and Instagram to get the latest information and educational opportunities.