05 Oct Good, Better, or Best: Preferred Equity or Common Equity?

The simple truth is that there’s no clear answer to this question because it depends on you as an investor. Both equity investments have their own equally important place in the minds of real estate investors, sponsors, and lenders. For our discussion, we will focus on the investors.

Diversify Your Portfolio with Preferred Equity

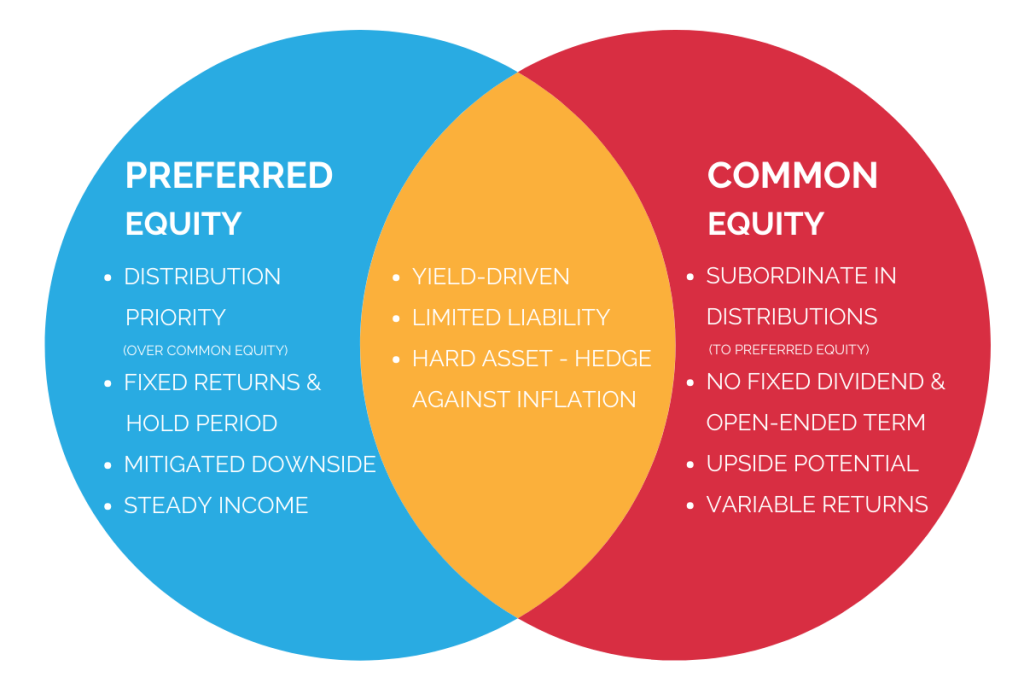

Most investors who are passive strive to develop a well-diversified portfolio that often includes Preferred and Common Equity to hedge against an ever-evolving financial landscape. While Common Equity is typically favored by investors seeking value addition and sizable asset appreciation over a more open-ended timeframe, typically 4-7 years, Preferred Equity investors seek a more predictable approach that provides a fixed rate of return with a liquidity date with a typical time frame of 2-4 years.

Mitigated Downside, Fixed Hold Term & Steady Income

Preferred Equity allows investors to participate in real estate investments while limiting an open time frame for the investment. It also provides steady income and a priority distribution, ultimately contributing to a balanced real estate portfolio. It is important to note that, unlike Common Equity, this position does not participate in the investment’s residual profits but provides stronger predictability.

Multifamily Provides Strong Fundamentals & High Demand

The past year has presented some new challenges for most investors and their investments, but multifamily has skillfully navigated these challenges through solid fundamentals and high demand. Despite year-over-year changes in the national rent index mirroring levels seen during the pandemic, the sector has displayed resilience, adapting to the evolving market conditions. If history is said to repeat itself, we should have much to look forward to.

Multifamily Can Outpace Inflation & Provide Higher Cash Yields

Multifamily real estate offers a well-grounded alternative to traditional public equity and debt markets, opening a door into a sector where rent growth has historically outpaced inflation. While multifamily real estate may not offer the same liquidity as public market investments, it compensates with long-term value growth. It can also be highly lucrative as it historically provides higher cash yields due to rental growth. The essence of multifamily investing is to preserve wealth through tangible, tax-advantaged assets that generate yield and offer the potential for significant capital appreciation over time.

Rewarding Opportunities For Investors In Preferred Equity

The multifamily housing sector, bolstered by Preferred Equity, unveils rewarding opportunities for investors. At Presario, our strategic investment approach in secure multifamily real estate offers a fulfilling venture toward a prosperous future. Discover the Presario difference today, and let your capital flourish in the multifamily landscape, fortified by the robust foundation of Preferred Equity.

Learn more about Presario’s investment strategy and how you can join our Exclusive Investor Community today.

Follow us on LinkedIn, Facebook, Twitter, and Instagram for the latest industry trends and educational opportunities.