16 Aug Multifamily Rents Continue Positive Momentum

MULTIFAMILY RENT GROWTH REMAINS A GOOD BET

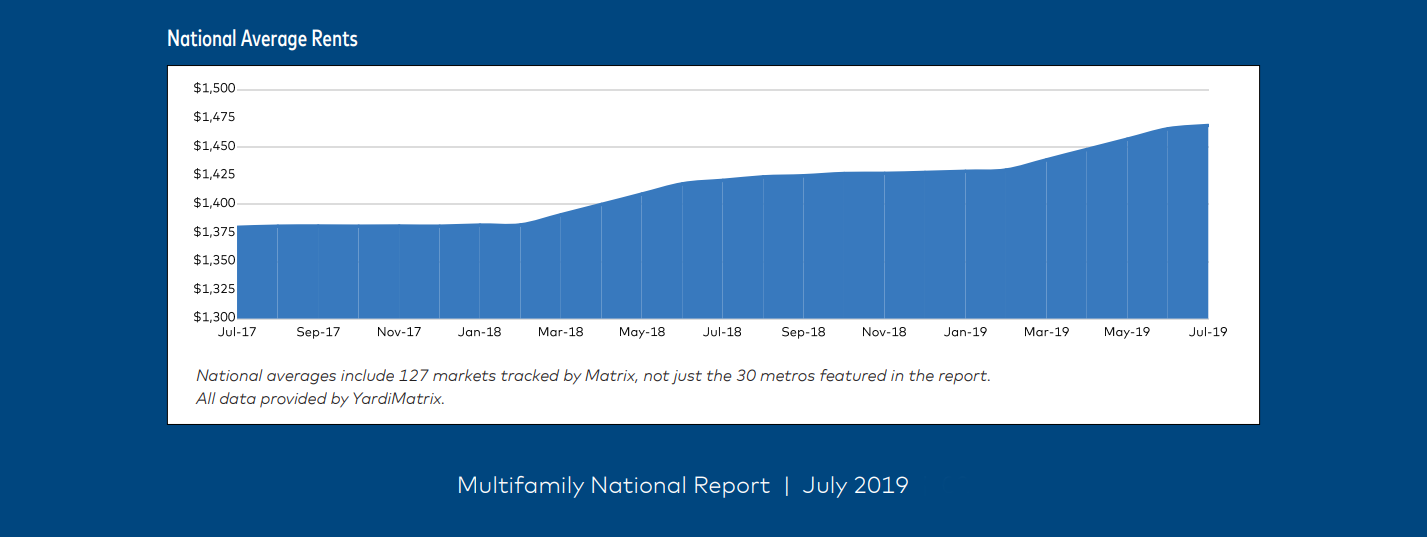

■ The average U.S. multifamily rent increased by $3 in July to $1,469. Year-over-year growth increased to 3.4%, up 10 basis points from June. Rent growth has remained at the 3.0% level or higher all year.

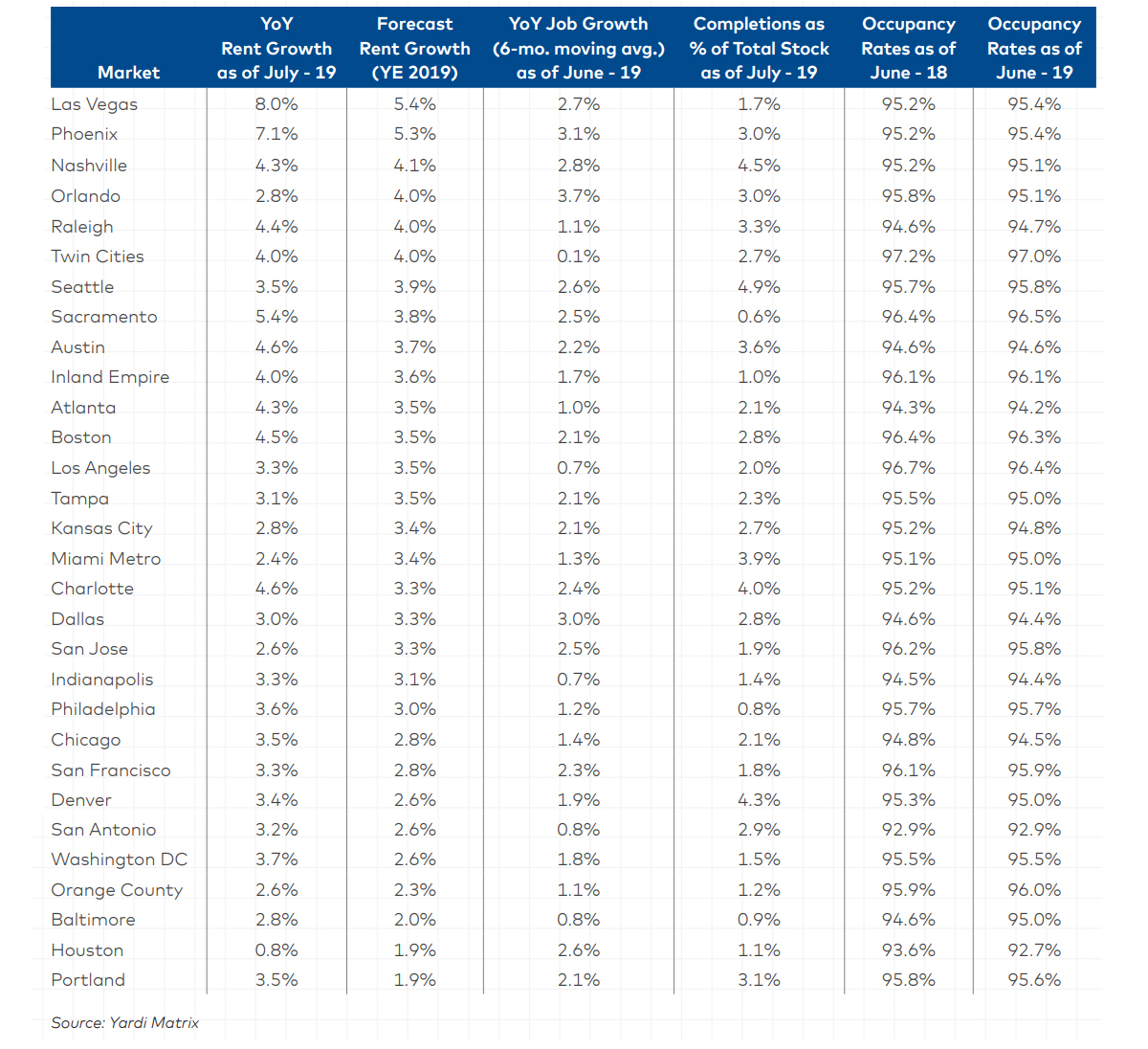

■ In this prolonged positive cycle going back at least six years, the consistency and geographic diversity of rent growth remain the most remarkable elements. Fast-growing metros in the South and Southwest, metros with strong technology industries, established metros in the Northeast and Midwest—all are producing healthy gains.

Multifamily rents continued their impressive and consistent performance, increasing by $3 in July to $1,469. Other than persistent weakness in a very small number of metros, particularly Houston, one has to strain very hard to find bad news in the national apartment rent numbers.

The healthy fundamental performance takes place amid questions about the economy. In the short run, lower interest rates convey benefits for multifamily. Property owners are rushing to lock in long-term mortgage rates, and multifamily should see strong capital inflows from investors seeking healthy and safe returns. But there is potential for market volatility and slower growth.

YEAR-OVER-YEAR RENT GROWTH: LIFESTYLE RENT GROWTH CONTINUES

■ Rent growth continued its strong 2019 trend, increasing 3.4% on a year-over-year basis in July. Annual rent growth has topped 3% on a year-over-year basis for each of the past 13 months.

■ Lifestyle rents continued their positive momentum, increasing 3.1% in July, the strongest growth for the segment since September 2016. Coming out of the Great Recession, rents for high-end luxury units grew at a faster pace than workforce housing, but in 2011 the trend reversed. For the last six years, Renter-by-Necessity rents have grown faster, as nearly 2 million luxury units have been delivered, dampening rent growth at the high end. The spread between RBN and Lifestyle rent growth widened until late 2017, and while RBN rents are still increasing faster than Lifestyle, the gap has narrowed to 50 basis points, its lowest since May 2012. Despite increasing headline risk of affordability issues with multifamily, the Lifestyle segment remains strong and growth is accelerating.

EMPLOYMENT, SUPPLY AND OCCUPANCY TRENDS; FORECAST RENT GROWTH

Read the full Yardi Matrix Multifamily National Report – July 2019 click here.

Sign up for Presario’s VIP newsletter and follow us on LinkedIn, Facebook, Twitter, and Instagram to get the latest information and educational opportunities.